Going Solo: The Rise of Single-Tenant Rentals

A growing trend in recent years has been the increase in the number of people opting to buy or rent properties on their own.

It’s a change that’s likely been on the radar of most commercial real estate (CRE) professionals working in the multifamily sector – though they might be hard-pressed to find the numbers to back it up.

Thanks to a recent report from Yardi’s RentCafe, however, we now have more data outlining how the solo tenant situation has developed, and where the trend might be going. Here are the highlights.

Lone rentals, on the rise

The analysis, which covers the period from 2016-2021, shows that the number of solo renters in the US jumped by 1 million people (or 6.7%) over five years. RentCafe notes: “That’s the fastest-rising renter group during those five years, having accelerated significantly during 2020.”

They add that the number of people living with family in rented apartments dropped from 71.3 million to 68.1 million over the same time period.

Metrics by metro

Naturally, there were also large variations in how the trend played out on a metro-by-metro basis:

Salt Lake City was the leader in solo rental growth (with an increase of 24.9%), followed by McAllen (24.2%), and Austin (23.9%).

RentCafe notes that the draw for many single renters in these areas is the surge in economic development they’ve seen in recent years. In Salt Lake City, for example, the rise of tech and the healthcare sectors mean an influx of new residents pursuing a different pace of life and a thriving job market.

Similarly, Austin has seen massive growth in the tech sector, making it an attractive proposition for industry professionals.

On the other end of the scale, in metros like San Jose, San Francisco, and Los Angeles, renters typically needed a much higher income to afford properties on their own. As a result, those cities had the lowest proportion of solo renters.

Demographic trends

The report also showed some interesting demographic trends, especially when it comes to the typical age group of single renters.

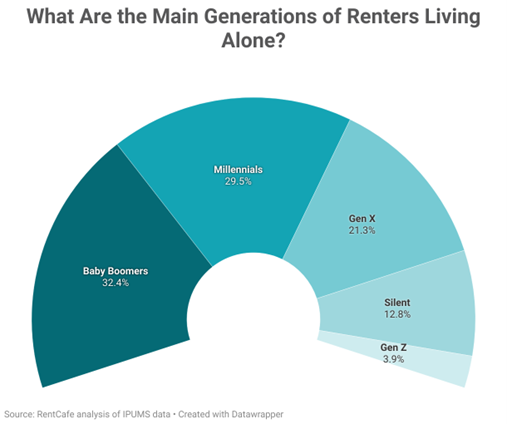

As the graph below shows, most individuals living alone were Baby Boomers or Millennials (61.9% taken together), while only 3.9% of Gen Z renters opted for solo living.

Supply and demand dynamics

The increase in the number of people opting to live alone might be good news for the apartment sector, given the large amounts of supply currently entering US markets.

In recent months, there’s also been increasing evidence that apartment rent growth is flattening out as a result. Redfin Economics Research Lead, Chen Zhao, notes: “There are still a lot of apartments under construction that will continue to hit the market, which should keep rents from increasing much in the near-to-medium term. But construction has started to slow, which should eventually help bolster rent prices.”

For multifamily real estate professionals, this means keeping track of growing trends – like the rise in solo rentals – is more important than ever. Especially because of the potential edge it provides in crafting marketing strategies that target the right prospective clients.